Asian Investors Expand Real Estate Portfolios Across Southeast Asia

Asian property buyers are shifting focus to Southeast Asia, with Cambodia, Thailand, Bali, and the Philippines leading in rental yield potential. Phnom Penh offers 8% to 10% returns.

A growing number of Asian property investors are choosing to allocate their capital within the region, particularly in Southeast Asia, as they seek to expand their real estate portfolios closer to home. This trend reflects a broader shift in investment preferences toward emerging markets offering attractive yields, streamlined entry conditions, and long-term growth potential.

Shift Towards Regional Real Estate Investment

Asian buyers, who have traditionally been active in global property markets such as Europe, North America, and parts of the Middle East, are now increasing their focus on regional assets. The accessibility, cultural proximity, and promising returns in Southeast Asia are playing a significant role in driving this investment shift.

Several countries in Southeast Asia are capturing the attention of these investors. Notably, Cambodia, Thailand, the Philippines, and Indonesia (specifically Bali) are gaining momentum due to favorable investment environments and emerging economic indicators.

Phnom Penh Emerges as a Strategic Investment Destination

Phnom Penh, the capital city of Cambodia, has emerged as a key hotspot in the regional property landscape. Investors are drawn to the city’s robust rental yield potential, which ranges between 8 percent and 10 percent annually. In addition to high returns, the Cambodian market offers investors benefits such as the absence of capital gains tax and lower property acquisition costs compared to more mature markets.

This combination of high rental yields and pro-investment policies makes Phnom Penh particularly appealing to yield-seeking investors who aim for consistent income streams and potential capital appreciation.

Thailand and Bali Maintain Their Allure

Thailand remains a preferred destination for regional property investors due to its stable property laws, strong tourism infrastructure, and well-developed real estate sector. The country's rental yield potential remains attractive, especially in urban centers and resort destinations.

Meanwhile, Bali continues to see substantial interest from investors, driven by its global tourism appeal, rising demand for short-term rentals, and increasing infrastructure development. The island's property market offers both lifestyle and income-generating benefits, attracting buyers looking for vacation homes that double as investment assets.

Philippines Attracting Rising Interest

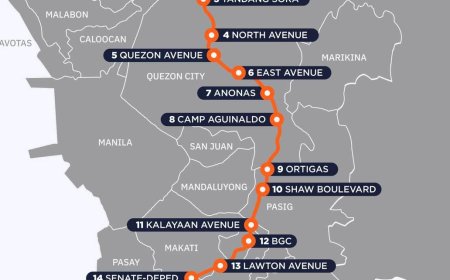

The Philippine property market is gaining increased attention as its economy grows and urban development accelerates. With rapid population growth, expanding urban centers, and a youthful workforce, the country presents long-term opportunities for both residential and commercial real estate investors.

Beyond Southeast Asia: Australia’s Consistent Performance

For investors seeking stability outside Southeast Asia, cities such as Sydney and Melbourne remain solid choices. These Australian cities offer reliable rental yields, strong legal frameworks, and consistent tenant demand, particularly in the residential rental market.

Strategic Considerations for Property Investors

To maximize returns and mitigate risks, investors are encouraged to collaborate with reputable property management firms that can ensure consistent maintenance, rental collection, and occupancy. Additionally, investors should not rely solely on tourism demand but should assess the broader economic trends, infrastructure plans, and urban development when selecting markets.

Capital appreciation should be a central consideration alongside rental income. Markets showing signs of economic expansion, demographic growth, and increased foreign direct investment typically offer better long-term capital growth potential.

Algene Toh

Disclaimer: The information presented on BSR2.com is intended for general informational purposes only. It does not constitute legal, financial, investment, or real estate advice and should not be relied upon as such. While every effort has been made to ensure the accuracy, reliability, and completeness of the content at the time of publication, all data is derived from publicly available sources and may be subject to change without notice. BSR2.com makes no representations or warranties of any kind, express or implied, regarding the suitability, timeliness, or accuracy of the information provided for any specific purpose. Users are strongly encouraged to seek independent advice from qualified professionals before making any decisions based on the content found on this website. BSR2.com shall not be held liable for any loss, damage, or consequence, whether direct or indirect, arising from the use of or reliance on the information provided. The content is intended as a general guide and does not take into account individual circumstances.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0