Guidelines on Pre-Approved Amendments to the Option to Purchase for Compliance with Anti-Money Laundering, Proliferation Financing, and Terrorism Financing Regulations

Learn about Singapore’s updated Option to Purchase rules and how pre-approved amendments help property developers comply with anti-money laundering, proliferation financing, and terrorism financing laws. This guide explains the rules step-by-step and provides Annex A in plain English.

In Singapore’s property market, transparency and legal compliance are crucial. Developers selling uncompleted properties are subject to strict legal requirements to prevent illegal financial activities such as money laundering, proliferation financing, and terrorism financing.

The Option to Purchase (OTP) a legal document used in property transactions has been updated to ensure developers fully meet these requirements. These changes, known as pre-approved amendments, are now available for developers to use without seeking individual approval from the Controller of Housing, as long as they follow the prescribed rules.

Step-by-Step Explanation of the Updates

Step 1: Mandatory Use of the Standard OTP

All developers selling uncompleted residential or commercial units must use the standard Option to Purchase set out under:

-

Housing Developers Rules for housing projects

-

Sale of Commercial Properties Rules for commercial developments

Any changes to this standard OTP normally require prior approval from the Controller of Housing.

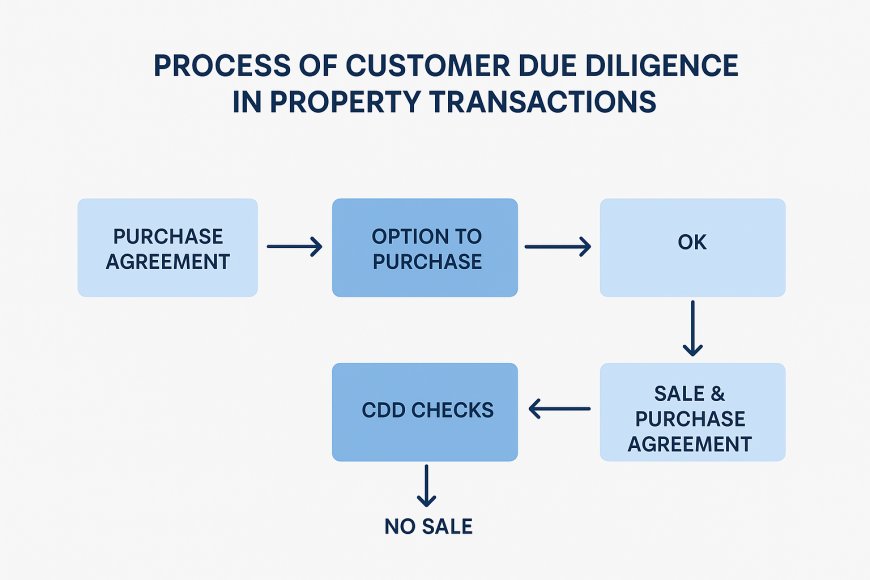

Step 2: Customer Due Diligence (CDD) is Compulsory

Under the Housing Developers (Prevention of Money Laundering, Proliferation Financing and Terrorism Financing) Rules 2023 and the Sale of Commercial Properties (Prevention of Money Laundering, Proliferation Financing and Terrorism Financing) Rules 2023, developers must verify the identity and legitimacy of purchasers.

This verification process is called Customer Due Diligence (CDD) and must be carried out before certain key actions, such as:

-

Issuing an Option to Purchase

-

Accepting booking fees or deposits

-

Signing a Sale & Purchase Agreement

CDD ensures that the purchaser’s funds come from legal sources and that the transaction is not linked to criminal activities.

Step 3: No Deal Without CDD Completion

If a developer cannot or chooses not to complete CDD because:

-

The purchaser fails to provide the required documents

-

The verification process cannot be completed

-

There are legal restrictions on proceeding

Then the developer is prohibited from:

-

Granting the purchaser an OTP for the property

-

Accepting any payment, including booking fees, from the purchaser

-

Entering into a Sale & Purchase Agreement for the property

This is to ensure no property transaction proceeds without proper checks.

Step 4: Pre-Approved Amendments for Faster Compliance

The Controller of Housing has now provided pre-approved amendments to the OTP (detailed in Annex A below).

These amendments:

-

Allow developers to clearly state in the OTP that it is subject to CDD completion

-

Can be used immediately without seeking separate approval

-

Help avoid legal breaches while streamlining compliance

Step 5: Applying Amendments to Existing OTPs

For OTPs already issued, developers can add the pre-approved wording if both parties agree.

This can be done via:

-

A side letter (an additional agreement attached to the original contract)

-

A supplemental agreement (an updated version of the OTP)

If the side letter or supplemental agreement only contains the pre-approved wording and no other changes, the Controller’s written approval is not required.

Pre-Approved Amendment in Plain Language

The pre-approved change to the OTP is a special clause that allows developers to withdraw the OTP if the buyer fails CDD checks or does not cooperate with the verification process.

Suggested Plain Language Clause:

“This Option to Purchase is issued on the condition that the Developer successfully completes all Customer Due Diligence checks as required by law. If the Developer is unable to complete these checks due to the Purchaser’s failure to provide the necessary documents or for any other reason stated under the relevant regulations, this Option to Purchase will automatically become invalid. In such cases, the Developer will not be obliged to proceed with the sale, and any money paid by the Purchaser will be refunded in full.”

How This Clause Protects Developers

-

Legal Protection: Prevents a developer from accidentally breaching anti-money laundering regulations.

-

Clear Communication: Informs purchasers upfront that legal checks are mandatory.

-

Automatic Termination: Clearly states that the OTP becomes invalid if CDD is not completed.

Key Takeaways for Developers

-

Always use the standard OTP format unless making approved changes.

-

Do not issue an OTP or accept payments until CDD is fully completed.

-

Use the pre-approved amendment to protect against legal risks.

-

Get purchaser agreement before adding amendments to existing OTPs.

Algene Toh

Disclaimer: The information presented on BSR2.com is intended for general informational purposes only. It does not constitute legal, financial, investment, or real estate advice and should not be relied upon as such. While every effort has been made to ensure the accuracy, reliability, and completeness of the content at the time of publication, all data is derived from publicly available sources and may be subject to change without notice. BSR2.com makes no representations or warranties of any kind, express or implied, regarding the suitability, timeliness, or accuracy of the information provided for any specific purpose. Users are strongly encouraged to seek independent advice from qualified professionals before making any decisions based on the content found on this website. BSR2.com shall not be held liable for any loss, damage, or consequence, whether direct or indirect, arising from the use of or reliance on the information provided. The content is intended as a general guide and does not take into account individual circumstances.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0